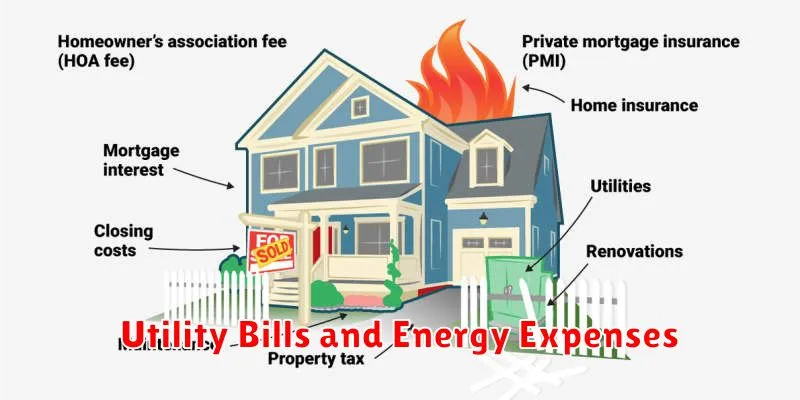

Owning a home is a significant investment, and while the upfront costs like down payments and closing costs are often top of mind, many individuals underestimate the hidden costs of homeownership. These unexpected expenses can quickly derail your budget and create financial strain if you’re not prepared. This guide will help you navigate the complexities of budgeting for these hidden costs, ensuring you’re financially prepared for the true cost of homeownership. Understanding these less obvious expenses, from property taxes and homeowners insurance to maintenance and repairs, is crucial for responsible homeownership.

Beyond the initial purchase price, a multitude of expenses arise throughout the years of owning a home. From routine maintenance costs to unexpected repairs, these hidden costs can significantly impact your finances. Learning to effectively budget for these expenditures is essential for a smooth and financially sound homeownership experience. This article will delve into the critical aspects of creating a realistic budget that accounts for the often overlooked hidden costs of owning a home, empowering you to make informed financial decisions and avoid potential pitfalls.

Beyond the Down Payment and Mortgage

Purchasing a home involves more than just securing a mortgage and making a down payment. Closing costs, often overlooked, can add a significant amount to the upfront expenses. These costs can include appraisal fees, loan origination fees, title insurance, and property taxes. It’s crucial to factor these expenses into your budget to avoid financial surprises at closing.

Once you’re a homeowner, the expenses don’t stop. Ongoing costs such as property taxes, homeowner’s insurance, and potential homeowners association (HOA) fees are essential to consider. Additionally, you’ll be responsible for maintenance and repairs, which can range from minor fixes to major system replacements. Creating a realistic budget that encompasses these recurring expenses is vital for successful homeownership.

Beyond the financial aspects, there are other important considerations. Researching the neighborhood, including schools, amenities, and commute times, is crucial. Understanding the local housing market and property values will help you make informed decisions. Finally, consider your long-term plans. How long do you intend to stay in the home? Will your needs change in the foreseeable future? Factoring these elements into your decision-making process can contribute to a positive homeownership experience.

Property Taxes and Home Insurance Explained

Property taxes are annual taxes levied on real estate owned by individuals or corporations. These taxes are typically based on the assessed value of the property, which is determined by local government assessors. Property tax revenue is a crucial source of funding for local services such as schools, libraries, and public safety. Failing to pay property taxes can lead to penalties, liens, and even foreclosure.

Home insurance, also known as homeowner’s insurance, is a type of property insurance that covers a private residence. It protects homeowners from financial losses caused by covered perils, such as fire, theft, and certain types of natural disasters. Policies typically cover the structure of the home, personal belongings, and liability for accidents that occur on the property. The cost of homeowner’s insurance varies depending on factors like location, coverage amount, and the home’s age and construction.

While both property taxes and home insurance are significant housing costs, they serve different purposes. Property taxes are a mandatory tax that funds local government, whereas home insurance is an optional (though highly recommended) purchase that protects homeowners from financial risk. Understanding both is essential for responsible homeownership.

HOA Fees and Maintenance Costs

Homeowners Association (HOA) fees are recurring payments made by homeowners in a planned community to cover the costs of shared amenities and services. These fees can vary significantly based on the community’s offerings and location. Common expenses covered by HOA fees include landscaping, pool maintenance, snow removal, trash collection, and exterior building upkeep. It’s crucial to understand what is and isn’t covered by your HOA fees before purchasing a property within a governed community. Failing to pay HOA fees can lead to penalties, liens against your property, and even foreclosure in extreme cases.

Maintenance costs are separate from HOA fees and are the responsibility of the individual homeowner. These costs cover repairs and upkeep within the boundaries of the owner’s property, such as interior repairs, appliance replacement, and private landscaping. While HOA fees cover the common areas, maintenance costs address the upkeep of the individual units. Proper budgeting for these costs is essential for responsible homeownership.

Understanding the distinction between HOA fees and maintenance costs is vital for making informed decisions about homeownership within a planned community. By factoring both into your budget, you can avoid unexpected financial burdens and ensure a positive homeownership experience. Consider seeking professional advice to better understand the financial implications of each before committing to a purchase.

Unexpected Repairs and Emergency Funds

Life is full of surprises, and not all of them are pleasant. Unexpected repairs, whether it’s a broken appliance, a leaky roof, or a necessary car repair, can put a serious strain on your finances. These unforeseen expenses can quickly derail your budget if you’re not prepared. Having an emergency fund is crucial for navigating these unexpected situations and avoiding financial hardship. It provides a safety net to cover these costs without resorting to high-interest debt like credit cards or payday loans.

Determining the appropriate amount for your emergency fund depends on your individual circumstances. A common recommendation is to save enough to cover three to six months of essential living expenses. This includes necessities such as rent or mortgage payments, utilities, groceries, and transportation. Consider factors like job security, health insurance coverage, and the number of dependents when calculating your target amount. Start small and gradually increase your savings over time. Even a small emergency fund is better than none.

Building and maintaining an emergency fund requires discipline and planning. Set a realistic savings goal and create a budget to track your income and expenses. Identify areas where you can cut back on spending and redirect those funds towards your emergency savings. Automate regular transfers to a dedicated savings account to make saving consistent and effortless. Remember to keep your emergency fund separate from your regular checking account to avoid the temptation to spend it on non-emergency expenses. With a well-funded emergency fund, you can face unexpected repairs with confidence and peace of mind.

Utility Bills and Energy Expenses

Utility bills represent the costs associated with essential services for your home or business. These typically include electricity, natural gas, water, and sewer services. Understanding your utility bills is crucial for managing your household or business budget effectively. Factors impacting these costs include your consumption rate, the time of year (seasonal changes), and the rates charged by your provider(s). Regularly reviewing your bills can help identify potential savings opportunities.

Energy expenses often comprise a significant portion of utility costs. Reducing energy consumption can lead to lower bills and a smaller environmental footprint. Simple actions like switching to energy-efficient appliances, using LED lighting, and properly insulating your home can make a noticeable difference. Smart thermostats and energy monitoring tools can provide further insights into your energy usage and help optimize consumption patterns.

Keeping track of your utility bills allows you to budget accurately and anticipate potential rate increases. Consider setting up automatic payments or budget billing to simplify the payment process and avoid late fees. If you experience difficulty paying your utility bills, contact your provider(s) to discuss potential assistance programs or payment arrangements.

Budgeting Tools for Homeowners

Managing household finances can be challenging. Thankfully, various budgeting tools are available to help homeowners track expenses, plan for future costs, and achieve financial goals. These tools range from simple spreadsheet templates to sophisticated software and mobile applications. Choosing the right tool depends on individual needs and preferences. Some popular options include budgeting apps like Mint or YNAB (You Need A Budget), spreadsheet software like Microsoft Excel or Google Sheets, and even traditional pen-and-paper methods.

Key features to look for in a budgeting tool include expense tracking, income monitoring, bill payment reminders, and reporting capabilities. Some tools offer additional features such as debt management, investment tracking, and financial goal setting. Regardless of the chosen method, the most important aspect is consistent usage. Regularly updating and reviewing your budget is crucial for identifying areas where you can save money and make informed financial decisions.

Starting a budget might seem daunting, but it doesn’t have to be. Begin by listing all your sources of income and categorizing your expenses. Then, track your spending for a month to understand where your money is going. Finally, create a realistic budget that aligns with your financial goals, whether it’s saving for a down payment, paying off debt, or building an emergency fund. Remember to review and adjust your budget periodically to ensure it remains relevant and effective.

How to Plan for the Long Term

Long-term planning requires a clear vision of your future. Start by defining your goals. Think about what you want to achieve in different areas of your life, such as your career, finances, relationships, and personal development. Be specific and set measurable targets, allowing you to track your progress and stay motivated.

Once you’ve established your goals, create a roadmap. Break down large goals into smaller, more manageable steps. This will make the overall process less daunting and provide a sense of accomplishment as you complete each milestone. Consider potential obstacles and develop contingency plans to address them proactively. Regularly review and adjust your plan as needed, adapting to changing circumstances and new opportunities.

Finally, cultivate the right mindset. Long-term planning requires patience, discipline, and resilience. Stay focused on your goals and maintain a positive outlook, even when faced with setbacks. Celebrate your successes along the way and remember that consistency is key to achieving your long-term aspirations.