Deciding between buying a condo or a house is a significant financial and lifestyle choice. This comprehensive guide will help you navigate the complexities of each option, weighing the pros and cons of condo ownership versus homeownership. Whether you’re a first-time homebuyer, looking to downsize, or simply exploring your real estate options, understanding the key differences between these two housing types is crucial. We’ll delve into the nuances of maintenance, amenities, HOA fees, property values, and more to equip you with the information you need to make an informed decision. Are you ready to find the perfect condo or house for your needs? Let’s explore.

Choosing the right property type, whether a condo or a house, hinges on understanding your individual circumstances and priorities. From considering your budget and desired lifestyle to evaluating the long-term investment potential, this article offers valuable insights to help you determine whether a condo or a house best aligns with your goals. We’ll examine factors like privacy, community living, resale value, and the responsibilities that come with each type of ownership. By carefully weighing these factors, you can confidently decide whether the convenience of a condo or the independence of a house is the right choice for you. Let’s dive into the details.

Differences Between Condos and Houses

The most fundamental difference between a condo and a house lies in ownership. When you buy a house, you own the building and the land it sits on. With a condo, you own the unit itself, but share ownership of the common areas like hallways, elevators, and amenities such as a pool or gym with other condo owners. This shared ownership is managed by a homeowners association (HOA) which sets rules and collects fees for maintenance and upkeep.

Another key difference involves maintenance and responsibilities. Homeowners are responsible for all maintenance inside and outside their house, from lawn care and snow removal to roof repairs and plumbing issues. Condo owners are typically only responsible for the interior of their unit, while the HOA handles exterior maintenance and repairs of common areas. This can be a significant advantage for those seeking a low-maintenance lifestyle.

Finally, cost and lifestyle considerations differentiate condos and houses. Condos are often more affordable than houses in the same area, especially in densely populated urban locations. They offer a convenient, low-maintenance lifestyle that appeals to busy professionals and those downsizing. Houses generally offer more privacy, space, and freedom to customize, but come with greater responsibility and potentially higher costs.

Initial Cost and Maintenance Comparison

Initial costs for equipment vary significantly depending on the type, features, and brand. For example, entry-level options often have lower upfront expenses but may lack advanced functionalities or durability found in higher-end models. Careful consideration of your specific needs and budget is crucial when making an initial purchase. Factoring in potential future upgrades or expansions can also help prevent unexpected expenses down the line.

Maintenance costs should be a key consideration. Routine maintenance, like cleaning and inspections, are typically less expensive but essential for preventing larger issues. Unscheduled repairs or replacements due to neglect or unexpected breakdowns can significantly impact overall cost. Choosing equipment with readily available parts and reliable service options can mitigate these risks and expenses.

Comparing the total cost of ownership (TCO) offers a more comprehensive perspective. TCO encompasses not only the initial price but also factors in projected maintenance, repair, and operating costs over the equipment’s lifespan. This approach allows for a more informed decision, balancing upfront investment with long-term expenses.

Amenities and Shared Facilities

Residents of this property enjoy access to a range of convenient amenities. These include a fully-equipped fitness center for maintaining an active lifestyle, a refreshing swimming pool for relaxation and recreation, and secure on-site parking for residents’ vehicles. These shared spaces are meticulously maintained to ensure a comfortable and enjoyable experience for all.

For added convenience, residents can also utilize the laundry facilities located within the building. This eliminates the need for individual in-unit laundry appliances, saving space and simplifying chores. Additionally, a community lounge area provides a comfortable space for socializing, relaxing, or working remotely.

Security is a top priority, with 24/7 surveillance and controlled access to the building. This ensures a safe and secure environment for all residents and their guests.

Resale Value and Appreciation

Resale value refers to the estimated price a property can command on the open market if sold at a given point in time. Several factors influence resale value, including location, property condition, market conditions, and recent comparable sales. Understanding resale value is crucial for homeowners and investors alike, as it helps determine potential return on investment and informs decisions about property improvements and upgrades.

Appreciation, on the other hand, is the increase in a property’s value over time. While resale value is a snapshot at a specific moment, appreciation reflects the long-term growth in market worth. Strong appreciation is generally a desirable outcome for property owners, as it builds equity and can contribute to long-term financial gains. Factors influencing appreciation can include economic growth, neighborhood improvements, and increased demand in a particular area.

Both resale value and appreciation are critical components of real estate investment decisions. While resale value offers a measure of current market worth, appreciation indicates potential future returns. Carefully evaluating both factors is essential for making informed choices about buying, selling, or holding onto a property.

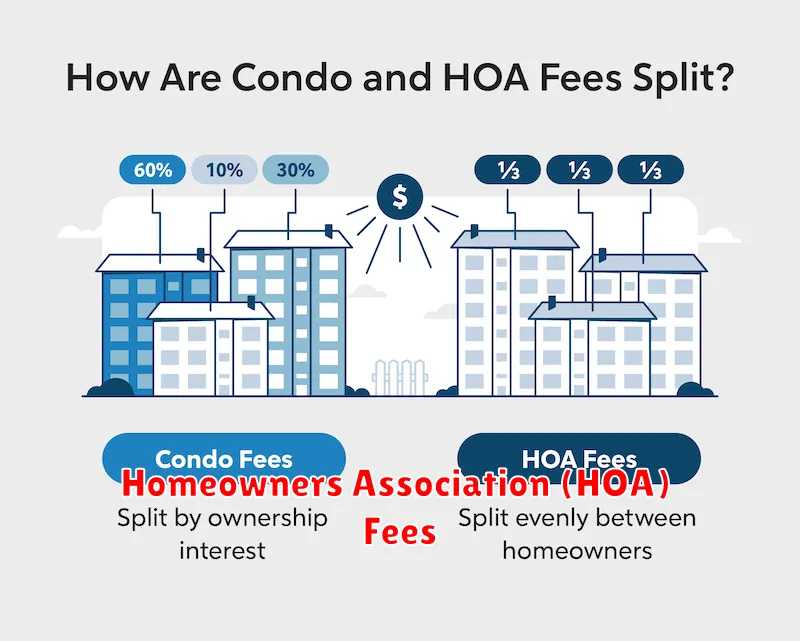

Homeowners Association (HOA) Fees

Homeowners Association (HOA) fees are recurring payments required of homeowners in certain planned communities or condominium buildings. These fees cover the costs of maintaining common areas and amenities such as landscaping, swimming pools, gyms, and security. The amount of the HOA fee varies depending on the community and the services provided. Understanding these fees is crucial before purchasing a property within an HOA.

HOA fees are typically paid monthly or quarterly. Failure to pay these fees can result in liens against your property, fines, and even foreclosure in some cases. It’s essential to budget for these fees as part of your overall housing expenses. Reviewing the HOA’s financial statements can help you understand how the funds are being utilized and ensure the association is fiscally responsible.

When considering a property with an HOA, carefully review the HOA’s governing documents, including the bylaws, covenants, conditions, and restrictions (CC&Rs). These documents outline the rules and regulations of the community, as well as the details of the HOA’s fees and responsibilities. This will help you understand what is expected of you as a homeowner and ensure the community aligns with your lifestyle.

Privacy and Lifestyle Preferences

Privacy is paramount. We understand the importance of keeping your information secure and confidential. We are committed to protecting your data and respecting your privacy choices. You can manage your privacy settings and preferences within your account, controlling what information is shared and how it is used. We strive to be transparent about our data practices and provide you with clear and accessible information about how we handle your personal information.

Your lifestyle preferences help us tailor experiences to your individual needs and interests. By understanding your preferences, we can provide you with more relevant content, recommendations, and services. This includes preferences related to communication, notifications, and the types of information you wish to receive. Sharing your preferences helps us create a more personalized and enjoyable experience.

Managing both your privacy and lifestyle preferences empowers you to control your online interactions. Empowerment through control and transparency is our goal. We encourage you to regularly review and update your settings to ensure they align with your evolving needs and expectations.

Which One Fits Your Long-Term Goals?

Choosing between different paths can be challenging. Consider your long-term aspirations. Do you prioritize stability, creativity, or leadership? Think about where you want to be in five, ten, or even twenty years. Aligning your choices with these goals will lead to more fulfilling outcomes. Evaluate the potential for growth and advancement within each option. Which path offers the most opportunities to develop your skills and reach your full potential?

Next, assess the risks and rewards associated with each path. Some options may offer higher earning potential but require more initial investment or come with greater uncertainty. Others may offer a better work-life balance but limit career advancement opportunities. Weigh these factors carefully based on your personal priorities and risk tolerance. Which path aligns best with your values and desired lifestyle?

Finally, gather information and seek advice from trusted mentors or professionals in the fields you’re considering. Learning from their experiences can provide valuable insights and help you make a more informed decision. Research the required skills and qualifications for each path, and consider any necessary steps you might need to take, such as further education or training. This will help you determine the feasibility of each option and your preparedness to pursue it.