Determining your home buying budget is the crucial first step in the exciting, yet often complex, journey of purchasing a home. Understanding how much house you can afford empowers you to make informed decisions, avoiding financial strain and ensuring a smooth transaction. This comprehensive guide will equip you with the necessary tools and knowledge to confidently establish a realistic home buying budget, taking into account not just the mortgage, but also associated costs like property taxes, insurance, and potential maintenance expenses. By carefully assessing your financial situation and utilizing the resources provided, you can embark on your house hunt with a clear understanding of your buying power.

Navigating the real estate market requires a solid understanding of your financial limitations. Accurately calculating your home affordability involves examining various factors, including your income, debt, credit score, and desired down payment. This introspective process allows you to identify a price range that aligns with your financial goals and avoids the pitfalls of overspending. By learning how to determine your home buying budget, you’ll be well-prepared to make offers with confidence and ultimately secure the home of your dreams within a realistic price range.

Why Budgeting Is the First Step

Creating a budget is the crucial first step towards achieving financial stability and reaching your financial goals. A budget provides a clear picture of your income and expenses, allowing you to track where your money is going. Without this understanding, it’s easy to overspend and accumulate debt, hindering your ability to save and invest for the future. Budgeting empowers you to make informed financial decisions, ensuring you prioritize essential expenses and allocate funds towards your goals, whether it’s buying a home, saving for retirement, or paying off debt.

The benefits of budgeting extend beyond simply managing expenses. By creating a budget, you can identify areas where you can reduce spending, freeing up money for savings or investments. It also allows you to anticipate potential financial challenges and adjust your spending accordingly, preventing you from falling into financial hardship. A well-planned budget provides peace of mind, knowing you have a plan in place to manage your finances effectively.

Furthermore, budgeting is a dynamic process that should be reviewed and adjusted regularly. Life changes, such as a new job or increased family expenses, require adapting your budget to reflect your current financial situation. Consistent monitoring and adjustments ensure your budget remains a relevant and effective tool in helping you achieve your financial aspirations.

Calculating Your Affordable Price Range

Determining your affordable price range for a home or other significant purchase requires careful consideration of your financial situation. Income, debts, and savings are key factors. Begin by calculating your debt-to-income ratio (DTI). This is the percentage of your gross monthly income that goes towards paying debts. A lower DTI indicates a stronger financial position and allows for a higher affordable price range. Lenders typically prefer a DTI of 43% or less. Additionally, consider your available down payment. A larger down payment reduces the loan amount and can impact your affordability range.

Next, use online affordability calculators or consult with a financial advisor to estimate your borrowing power. These tools take into account factors like interest rates, loan terms, and property taxes to provide a realistic estimate of how much you can afford. Be sure to factor in additional expenses beyond the principal and interest payments. These include homeowner’s insurance, potential maintenance costs, and private mortgage insurance (PMI) if your down payment is less than 20%.

Finally, while calculations can provide a helpful starting point, consider your personal comfort level. Purchasing a home within your affordable range doesn’t guarantee financial stability. It’s essential to leave room in your budget for unexpected expenses and maintain a healthy financial safety net. Consider your long-term financial goals and avoid stretching your finances too thin, even if it means choosing a less expensive option.

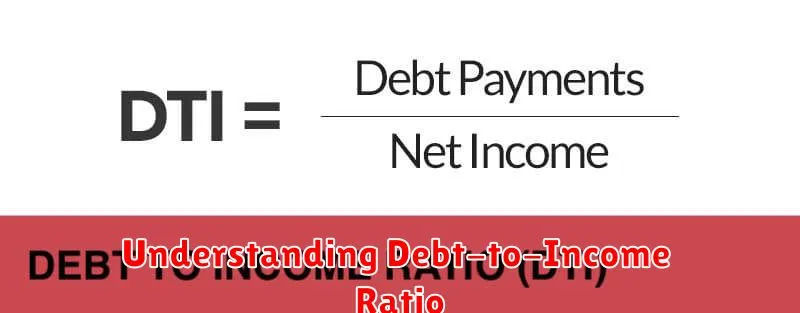

Understanding Debt-to-Income Ratio

The debt-to-income ratio (DTI) is a crucial financial metric that compares your monthly debt payments to your gross monthly income. It is expressed as a percentage and is used by lenders to assess your ability to manage your debts and repay a potential loan. A lower DTI generally indicates that you have a good balance between debt and income, making you a less risky borrower. Higher DTIs, on the other hand, suggest that a significant portion of your income is allocated to debt repayment, potentially impacting your ability to meet future financial obligations.

Calculating your DTI is straightforward. First, add up all your recurring monthly debt payments, including mortgage or rent, auto loans, student loans, minimum credit card payments, and any other personal loans. Then, divide this total by your gross monthly income, which is your income before taxes and other deductions. Multiply the result by 100 to express your DTI as a percentage. For example, if your monthly debt payments are $1,500 and your gross monthly income is $5,000, your DTI is (1500/5000) * 100 = 30%.

Lenders typically prefer a DTI of 43% or less, although requirements can vary depending on the loan type and the individual lender. A DTI above this threshold might make it more challenging to qualify for a loan or result in less favorable terms. Managing your DTI effectively is essential for maintaining a healthy financial profile. Strategies for improving your DTI include paying down debt aggressively, increasing your income, and avoiding taking on new debt unless necessary.

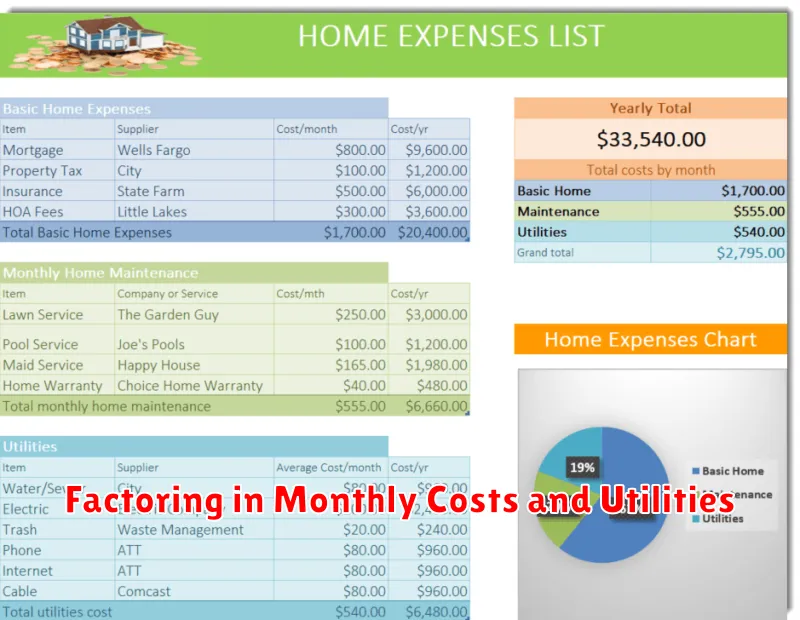

Factoring in Monthly Costs and Utilities

Accurately budgeting requires a comprehensive understanding of your monthly expenses. This includes not only obvious costs like rent or mortgage payments, but also recurring utilities such as electricity, water, gas, and internet service. Additional expenses to consider are trash/recycling collection, sewer services, and any homeowner’s association (HOA) fees. Carefully tracking these costs is vital for effective financial management.

Beyond essential utilities, consider other regular expenses that impact your monthly budget. These might include cell phone service, streaming subscriptions, gym memberships, or insurance premiums (health, car, renters/homeowners). While some of these are adjustable, others are fixed and must be factored into your monthly spending plan. Distinguishing between needs and wants can help prioritize and allocate funds appropriately.

Creating a detailed budget allows you to anticipate and manage your monthly financial obligations. By proactively accounting for all recurring costs and utilities, you can avoid unexpected financial strain and build a stronger financial foundation for the future. This practice promotes financial stability and allows for better long-term planning.

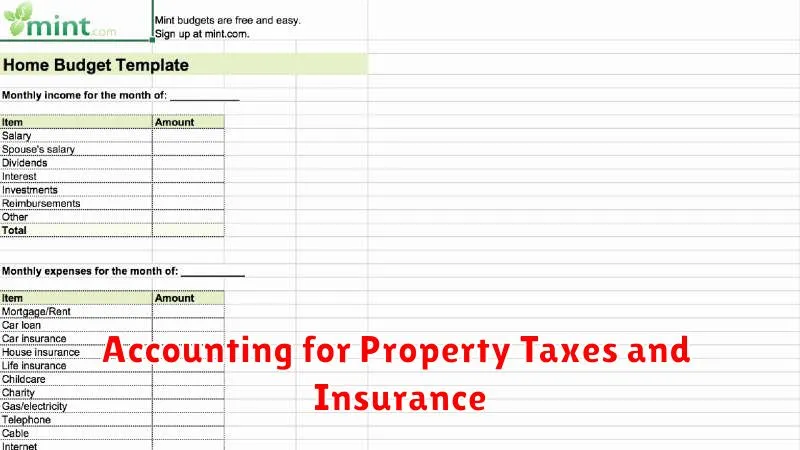

Accounting for Property Taxes and Insurance

Property taxes and insurance are significant expenses related to property ownership. Property taxes are levied by local governments and are based on the assessed value of the property. Insurance protects the property owner from financial loss due to unforeseen events like fire, theft, or natural disasters. Both of these expenses are typically prepaid for a specific period, such as a year.

When these expenses are prepaid, they are initially recorded as prepaid assets on the balance sheet. As the period covered by the prepayment elapses, the portion representing the expired amount is recognized as an expense. This gradual recognition of expense is known as amortization. For example, if property taxes are prepaid for a year, one-twelfth of the prepayment is expensed each month.

The accounting entries typically involve debiting an expense account (Property Tax Expense or Insurance Expense) and crediting the prepaid asset account (Prepaid Property Taxes or Prepaid Insurance). This process accurately reflects the cost of these items over the period they benefit.

Setting Aside Money for Emergencies

Life is full of unexpected events, and having a financial safety net can make all the difference. Setting aside money specifically for emergencies can help you avoid going into debt when faced with unexpected expenses like car repairs, medical bills, or job loss. Building an emergency fund provides peace of mind and financial stability, allowing you to navigate challenging situations more effectively.

Experts recommend saving enough to cover three to six months of essential living expenses. This amount will vary depending on your individual circumstances, such as your income, dependents, and cost of living. Start small if needed, even setting aside a small amount each week will add up over time. Consider automating your savings by setting up regular transfers from your checking account to a dedicated savings account earmarked for emergencies.

To ensure your emergency fund remains easily accessible, choose a liquid savings account that offers easy access to your funds without penalties. Consider a high-yield savings account to maximize your interest earnings. Remember, this money is specifically for true emergencies, so avoid dipping into it for non-essential purchases. Resist the temptation to use these funds for vacations, new electronics, or other non-essential items. By keeping this money separate and only using it for its intended purpose, you’ll be well-prepared for whatever life throws your way.

Using Online Mortgage Calculators

Online mortgage calculators are powerful tools for anyone considering buying a home or refinancing an existing mortgage. They provide quick estimates of monthly payments based on loan amount, interest rate, and loan term. By adjusting these variables, you can see how different scenarios impact your potential monthly expenses and overall loan cost. These calculators can also help you compare different loan offers and understand the long-term financial implications of your mortgage decisions.

It’s important to remember that these calculators typically provide estimates and may not include all costs associated with a mortgage, such as property taxes, insurance, and closing costs. Therefore, while they are valuable for initial planning and comparison shopping, it’s crucial to consult with a qualified mortgage lender to get a precise understanding of your total costs and to receive personalized advice tailored to your individual financial situation.

When using an online mortgage calculator, be sure to enter accurate information to get the most reliable results. Key inputs include the loan amount (purchase price minus down payment), interest rate, loan term (typically 15 or 30 years), and property taxes (if known). Some calculators may also offer options to include private mortgage insurance (PMI), homeowners insurance, and HOA fees, allowing for a more comprehensive estimate of monthly housing costs.