Are you ready to embark on the exciting, yet often daunting, journey of buying a home? One of the most essential first steps is securing home loan pre-approval. This essential guide to home loan pre-approval will provide you with a comprehensive understanding of the process, benefits, and requirements needed to obtain pre-approval. Understanding the home loan pre-approval process is crucial for navigating the competitive real estate market and positioning yourself as a serious buyer. From defining what home loan pre-approval is to outlining the necessary documentation, this guide will equip you with the knowledge to confidently begin your home-buying journey.

Getting pre-approved for a home loan offers numerous advantages, giving you a clear picture of your budget and strengthening your negotiating power. This guide will delve into the importance of home loan pre-approval, explaining how it can give you a competitive edge in a fast-paced market. Learn how pre-approval for a mortgage can streamline the entire home buying experience, from making offers to closing the deal. By following the advice and insights within this essential guide, you’ll be well-prepared to secure the home loan you need to purchase your dream home.

What Is a Mortgage Pre-Approval?

A mortgage pre-approval is a letter from a lender indicating how much money they are willing to lend you to buy a home. It’s an important step in the home-buying process because it shows sellers that you’re a serious buyer and have the financial backing to purchase their property. Getting pre-approved involves submitting a mortgage application and providing documentation verifying your income, assets, and debts. The lender will review this information and assess your creditworthiness to determine the loan amount you qualify for.

A pre-approval is different from a pre-qualification, which is a less formal estimate of how much you might be able to borrow. A pre-qualification is typically based on information you provide verbally, whereas a pre-approval requires official documentation and a credit check. A pre-approval carries significantly more weight with sellers and is a crucial tool in a competitive housing market. It allows you to make offers with confidence, knowing your financing is likely secured.

While a pre-approval is a strong indicator of your ability to secure a mortgage, it’s not a guarantee. The final loan approval is contingent upon several factors, including a satisfactory appraisal of the property and a clear title search. However, a pre-approval provides a solid foundation for your house hunting journey and helps you narrow your search to properties within your affordable price range.

Why Pre-Approval Is Crucial for Buyers

In the competitive real estate market, pre-approval is a critical first step for prospective homebuyers. It provides a clear picture of your borrowing power, giving you a realistic budget and allowing you to search for homes within your affordable range. Knowing your pre-approved amount empowers you to make confident offers, demonstrating to sellers that you are a serious and qualified buyer. This can give you a significant advantage, particularly in situations with multiple offers.

Pre-approval involves a thorough review of your financial situation by a lender, including your credit score, income, and debt-to-income ratio. This process determines the maximum loan amount you are eligible for and the interest rate you can expect. Having this information readily available streamlines the home buying process, enabling you to move quickly when you find the right property. Furthermore, understanding your budget beforehand helps avoid the disappointment of falling in love with a home outside your financial reach.

Sellers often prefer working with pre-approved buyers, as it signifies a higher likelihood of a successful closing. Pre-approval demonstrates your financial preparedness and commitment to the purchase. It can make your offer stand out and increase your negotiating power. In essence, pre-approval provides credibility and positions you as a strong contender in the real estate market.

How to Prepare Financially

Financial preparedness involves building a strong foundation to weather unexpected expenses and achieve long-term goals. Start by creating a budget to track income and expenses. Identify areas where you can reduce spending and allocate funds towards savings and debt reduction. Building an emergency fund, typically covering 3-6 months of essential expenses, provides a safety net for unexpected events like job loss or medical emergencies.

Next, prioritize saving for both short-term and long-term goals. Short-term goals might include a down payment on a car or a vacation, while long-term goals often focus on retirement or a child’s education. Consider various savings vehicles such as high-yield savings accounts, certificates of deposit (CDs), or investment accounts tailored to your risk tolerance and time horizon.

Finally, protect your financial well-being through appropriate insurance coverage. This includes health insurance to manage medical costs, auto insurance to cover accidents, and homeowners or renters insurance to protect your property. Estate planning, including wills and beneficiaries, ensures your assets are distributed according to your wishes. Regularly reviewing and adjusting your financial plan as your circumstances change is crucial for long-term financial success.

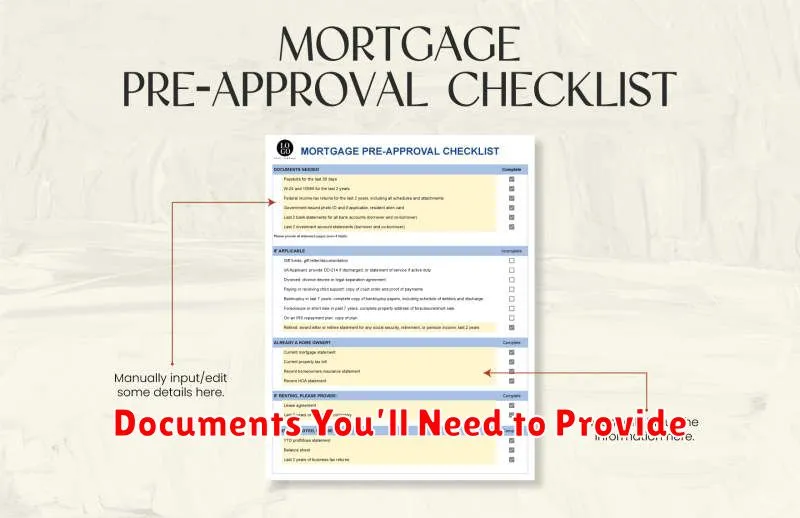

Documents You’ll Need to Provide

To ensure a smooth and efficient process, please gather the following required documents. Having these prepared in advance will expedite the application or request.

Typically, you will need to provide proof of identification, such as a valid driver’s license, passport, or state-issued ID card. Additionally, proof of residence is often necessary, which may include a recent utility bill, bank statement, or lease agreement. Depending on the specific nature of your request, further documentation may be required, so it’s always best to confirm the full list of necessary documents beforehand.

By having these documents ready, you can help avoid delays and ensure a timely completion of your application or request. We appreciate your cooperation.

How Lenders Evaluate Your Application

Lenders use a variety of factors to assess your creditworthiness and determine whether to approve your loan application. The primary factors include your credit score, which reflects your credit history and payment patterns, your income and employment history, which demonstrate your ability to repay the loan, and your debt-to-income ratio (DTI), which measures your monthly debt obligations against your gross monthly income. Lenders want to see a stable income and a manageable DTI, indicating you can handle the additional debt of a loan.

Beyond these core elements, lenders also consider the loan amount, the loan term, and the type of loan you’re seeking. These factors influence the risk associated with the loan and affect the interest rate and other loan terms offered. For example, a larger loan amount or a longer loan term may represent a higher risk for the lender, potentially resulting in a higher interest rate. Similarly, secured loans, backed by collateral, generally carry lower interest rates than unsecured loans.

Finally, lenders may also review your credit report for any negative marks, such as late payments, collections, or bankruptcies. They also consider your available assets, such as savings, investments, and property, which provide additional financial security. A strong credit history with minimal negative marks, combined with demonstrable assets, can strengthen your application and improve your chances of loan approval.

Common Mistakes to Avoid in the Process

One common mistake is inadequate planning. Thorough planning is crucial for success and involves clearly defining goals, outlining necessary steps, and anticipating potential challenges. Failing to properly plan can lead to delays, cost overruns, and ultimately, an unsuccessful outcome. Another frequent error is poor communication. Effective communication between all stakeholders ensures everyone is on the same page and working towards the same objectives. Miscommunication can cause confusion, conflict, and ultimately hinder progress.

A further mistake is neglecting risk assessment. Identifying and mitigating potential risks is vital. Ignoring potential problems can lead to unforeseen setbacks and jeopardize the entire process. By proactively addressing potential issues, you can minimize negative impacts and increase the likelihood of a positive outcome. Finally, a lack of proper documentation is a common oversight. Meticulous documentation throughout the entire process is essential for tracking progress, identifying areas for improvement, and ensuring accountability.

By avoiding these common pitfalls, you can significantly improve your chances of success and achieve your desired results. Remember to prioritize planning, communication, risk assessment, and documentation for a smoother, more efficient process.

What to Do After Getting Pre-Approved

Getting pre-approved for a loan is a significant step in the borrowing process. It means a lender has reviewed your financial information and determined you’re likely eligible for a loan up to a certain amount. Now it’s time to shop smartly. Compare loan offers from different lenders, paying close attention to the interest rate, loan terms, and any associated fees. A pre-approval doesn’t guarantee final approval, so continue to manage your finances responsibly. Avoid making large purchases or opening new lines of credit until your loan is finalized.

Once you’ve chosen a lender and specific loan offer, you’ll need to submit a formal application. This usually involves providing more detailed documentation like pay stubs, tax returns, and bank statements. The lender will then conduct a hard credit check, which may temporarily impact your credit score. Be prepared to answer any questions the lender might have about your application.

After your loan is officially approved, carefully review the final loan documents before signing. Make sure the terms and conditions match what you agreed upon. Once everything is in order, you’ll finalize the loan and receive the funds. Congratulations on taking this important step toward your financial goals!