Understanding homeowners insurance is a crucial step before purchasing a home. This comprehensive guide will equip you with the essential knowledge needed to navigate the complexities of homeowners insurance policies. From understanding different coverage types and policy limits to comparing deductibles and premiums, we’ll delve into the core components of a policy. We will also explore how factors such as your location, home’s age, and construction materials can impact your insurance costs. Learning the intricacies of homeowners insurance empowers you to make informed decisions, securing the right protection for your valuable investment.

Before you commit to a mortgage, it’s vital to comprehend the financial implications of homeownership, including homeowners insurance costs. This article will help you understand the importance of homeowners insurance, providing clarity on the coverage options available and how to choose a policy that aligns with your specific needs and budget. By understanding the nuances of homeowners insurance, you can avoid costly surprises and protect your financial future. Learn how to evaluate insurance providers, compare quotes, and ultimately choose the best homeowners insurance policy for your new home. This guide will give you the confidence to make a well-informed decision, ensuring you’re adequately protected from potential risks and liabilities.

What Is Homeowners Insurance?

Homeowners insurance is a type of property insurance that covers a private residence. It combines various personal insurance protections, which can include losses occurring to one’s home, its contents, loss of use (additional living expenses), or loss of other personal possessions of the homeowner, as well as liability insurance for accidents that may happen on the property. It is a package policy, meaning that it covers both damage to property and liability or legal responsibility for any injuries and property damage caused to other people. Different levels of coverage exist depending on the needs of the individual homeowner.

Several key areas of coverage are typically included in standard policies. Dwelling coverage protects the physical structure of the home and attached structures like a garage. Personal property coverage protects belongings inside the house against covered perils like fire or theft. Loss of use coverage pays for additional living expenses if a home becomes uninhabitable due to a covered event. Liability protection covers the homeowner against lawsuits for bodily injury or property damage that the homeowner or family members cause to other people.

Homeowners insurance policies usually exclude coverage for certain perils, meaning specific events that cause damage. Common exclusions include floods, earthquakes, and normal wear and tear. Separate insurance policies can be purchased for some of these exclusions, such as flood insurance through the National Flood Insurance Program. Understanding what is and isn’t covered under a homeowners policy is crucial for ensuring adequate financial protection in case of unforeseen events. It is important to review your policy details and discuss your coverage needs with your insurance agent.

Why Lenders Require It

Lenders require various documents and information before approving a loan to assess the borrower’s creditworthiness and ability to repay. This process, known as underwriting, helps mitigate the risk for the lender. By verifying income, employment history, and credit score, lenders gain a clearer picture of the borrower’s financial stability. This information allows them to determine the appropriate loan amount, interest rate, and repayment terms. Ultimately, these requirements protect both the lender and the borrower by ensuring responsible lending practices and a higher likelihood of successful loan repayment.

A key aspect of this process is evaluating the borrower’s capacity to repay the loan. Lenders assess the borrower’s debt-to-income ratio (DTI), which compares their monthly debt obligations to their gross monthly income. A high DTI indicates a greater risk of default, while a lower DTI suggests a stronger ability to manage additional debt. Furthermore, lenders scrutinize credit reports to identify past payment history, outstanding debts, and any derogatory marks that may signal financial instability. This thorough evaluation helps lenders make informed decisions about loan approvals and minimize potential losses.

In addition to assessing creditworthiness, lenders require documentation for legal and regulatory compliance. These requirements vary depending on the type of loan and the governing regulations. For example, mortgage lenders typically require proof of homeowner’s insurance to protect their investment in the property. By adhering to these legal and regulatory guidelines, lenders ensure the validity and enforceability of the loan agreement while protecting themselves from potential fraud and other risks.

Types of Coverage You Should Know

Understanding insurance coverage can be crucial for protecting yourself and your assets. There are various types of coverage available, each designed for specific needs. Some common types include liability coverage, which protects you against financial responsibility for injuries or damages to others; property coverage, which protects your belongings from events like fire or theft; and comprehensive coverage, which offers broader protection, often including damage from events like natural disasters. Choosing the right coverage depends on individual circumstances and risk assessment.

Beyond these common types, more specialized coverage options exist. For example, umbrella insurance provides additional liability coverage beyond the limits of your standard policies. Disability insurance replaces a portion of your income if you’re unable to work due to illness or injury. Health insurance helps cover medical expenses, while life insurance provides financial support to your beneficiaries in the event of your death. Carefully considering your needs and potential risks can help you determine which types of specialized coverage are appropriate.

It’s important to note that policy details and specific coverage options can vary significantly between providers. Therefore, thoroughly reviewing policy documents and comparing quotes from different insurers is highly recommended. Consulting with an insurance professional can also provide valuable insights and guidance in selecting the right coverage for your individual situation.

How to Compare Insurance Quotes

Comparing insurance quotes is crucial for finding the best coverage at the most affordable price. Begin by identifying your specific needs. What type of insurance are you seeking (e.g., auto, home, life)? What level of coverage do you require? Once you have a clear understanding of your needs, gather quotes from multiple insurers. You can do this online, through an agent, or by contacting insurance companies directly. Be sure to provide accurate and consistent information to each insurer to ensure comparable quotes. Pay close attention to the coverage details, including deductibles, premiums, and policy limits.

When evaluating quotes, don’t focus solely on price. A lower premium may mean less coverage. Carefully examine the policy terms and conditions. Consider the insurer’s reputation and financial stability. Check online reviews and ratings from independent agencies like A.M. Best or Standard & Poor’s. A reputable insurer will offer reliable customer service and handle claims efficiently. Look for a company with a strong track record of paying claims promptly and fairly.

Finally, after thoroughly comparing quotes, select the policy that best meets your needs and budget. Don’t be afraid to ask questions if anything is unclear. Contact the insurer directly to discuss the policy details and ensure you understand the coverage. Making an informed decision will provide peace of mind knowing you have the right protection in place.

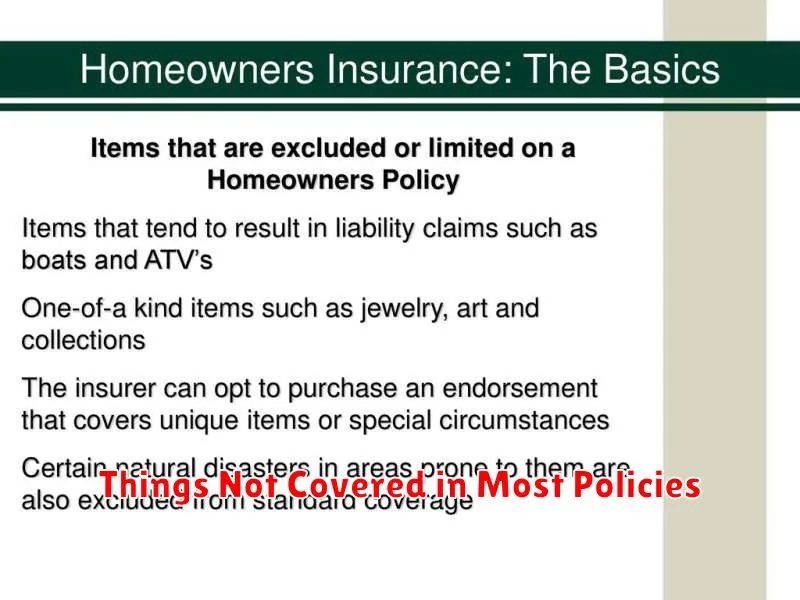

Things Not Covered in Most Policies

Most insurance policies, whether for home, auto, or health, have specific exclusions. These are situations or events that the policy specifically will not cover. Understanding these exclusions is critical to avoiding unexpected costs. Common exclusions can include acts of war, nuclear hazards, intentional acts of the insured, and certain types of damage like flooding (often requiring a separate flood insurance policy), earthquakes, or normal wear and tear.

Furthermore, many policies have limits on coverage amounts. This means that even if a loss is covered, the policy may only pay up to a certain amount. Paying attention to coverage limits for different categories of loss, like personal property or liability, is essential. It’s important to evaluate if these limits adequately protect you and consider increasing them if necessary.

Finally, be aware of specific requirements for filing a claim and meeting policy conditions. For instance, there may be deadlines for reporting an incident or specific documentation required. Failure to comply with these conditions can result in a denied claim. Carefully review your policy documents or contact your insurance provider to understand all the requirements and responsibilities.

How Much Coverage Do You Need?

Determining the right amount of insurance coverage depends on your individual circumstances and the specific type of insurance. For life insurance, consider your financial obligations, such as mortgage payments, debts, and future expenses like college tuition. Also, factor in income replacement for your dependents. For auto insurance, state minimums are often insufficient. Higher liability coverage protects you financially if you cause an accident. Adequate homeowners or renters insurance should cover the cost of rebuilding or replacing your belongings in case of damage or theft.

A helpful way to assess your needs is to create a personal inventory. List your assets, liabilities, and potential risks. Think about worst-case scenarios and how much money you would need to recover. Consulting with a qualified insurance professional can provide personalized guidance and help you choose appropriate coverage amounts.

Don’t focus only on premiums. While cost is a factor, insufficient coverage can leave you financially vulnerable in the event of a claim. Finding the right balance between affordability and adequate protection is key to ensuring your peace of mind.

Filing a Claim: Step-by-Step Guide

First, gather all necessary documentation. This typically includes the claim form itself, any incident reports, medical bills, and other supporting evidence relevant to your claim. Ensure all information is accurate and complete to avoid delays in processing. Organize these documents clearly for easy submission.

Second, carefully review the claim form instructions. Each claim type might have specific requirements. Fill out the form completely and legibly, paying close attention to required fields. Provide clear and concise explanations of the incident, ensuring all details are accurate. If you have questions, contact the appropriate claims representative for assistance.

Finally, submit your completed claim form and supporting documents through the designated channel. This might involve mailing physical copies, uploading documents online, or submitting via fax. Retain copies of all submitted materials for your records. You should receive confirmation of receipt and further instructions regarding the claim review process.