Rent-to-own homes, also known as lease-purchase agreements or lease options, offer a unique pathway to homeownership, particularly for those who may not qualify for a traditional mortgage immediately. This arrangement combines renting and buying, allowing prospective buyers to live in the home while working towards eventual ownership. Understanding the intricacies of rent-to-own agreements is crucial before entering into such a contract, as they involve both benefits and potential risks. This article explores the mechanics of rent-to-own homes, outlining how these agreements function and highlighting key factors to consider before making a decision.

Navigating the process of securing a rent-to-own home requires careful consideration of various aspects. From understanding the option fee and purchase price to evaluating the terms of the lease agreement, prospective buyers must be well-informed. This introduction provides a comprehensive overview of rent-to-own homes, covering crucial details such as responsibilities for maintenance and repairs, potential benefits and drawbacks, and critical questions to ask before signing on the dotted line. Whether you are exploring alternative paths to homeownership or simply curious about rent-to-own options, this guide provides valuable insights into this unique real estate approach.

What Is a Rent-to-Own Agreement?

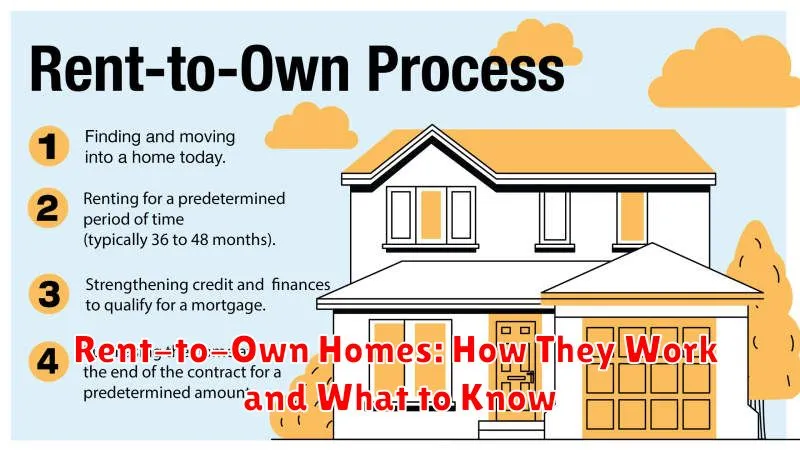

A rent-to-own agreement, also known as a lease-purchase agreement, allows a tenant to rent a property for a specific period with the option to purchase it at the end of the lease term. This arrangement offers a pathway to homeownership for individuals who may not be ready to purchase a home outright. The agreement typically outlines the rental payments, a portion of which may go towards a down payment, the purchase price of the property, and the terms of the eventual sale.

These agreements consist of two key parts: a standard lease agreement and an option to purchase. The lease portion details the monthly rent, the responsibilities of both the landlord and the tenant, and the lease duration. The option to purchase portion dictates the predetermined price at which the tenant can buy the property and the timeframe within which they can exercise this option. Negotiating these terms is crucial, as they significantly impact the eventual purchase price and the tenant’s overall financial commitment.

Rent-to-own agreements can be beneficial for individuals who need time to improve their credit scores or save for a traditional down payment. However, it’s important to understand the potential risks. If the tenant chooses not to purchase the property at the end of the lease term, they typically forfeit any money paid toward the purchase option. Therefore, careful consideration of the agreement’s terms and one’s financial situation is essential before entering into a rent-to-own arrangement.

Pros and Cons of Using AI Writing Tools

AI writing tools offer several advantages. They can increase content production speed significantly, allowing businesses to create more content in less time. They can also help maintain consistency in brand voice and messaging across various platforms. Furthermore, these tools can assist with tasks such as grammar and spelling checks, ensuring error-free content. However, relying solely on AI-generated content can lead to a lack of originality and creativity. It’s also important to note that while AI can improve writing efficiency, human oversight is crucial for ensuring accuracy and avoiding the spread of misinformation.

One major concern surrounding AI writing tools is the potential for plagiarism. While most reputable tools strive to generate original content, there is always a risk of unintentional duplication. This risk underscores the importance of thorough review and editing by human writers. Another disadvantage is the limited emotional intelligence of AI. While AI can generate grammatically correct and factually accurate text, it often struggles to convey nuances of emotion or incorporate creative storytelling, which can be crucial for engaging content.

Ultimately, AI writing tools can be valuable assets when used responsibly. They can be effective for generating basic content, streamlining workflows, and improving writing efficiency. However, it’s essential to prioritize human oversight to ensure quality, accuracy, and originality. The most effective approach often involves leveraging the strengths of both AI and human writers, combining the efficiency of AI with the creativity and critical thinking of human intelligence.

How to Qualify for a Rent-to-Own Deal

Rent-to-own agreements, also known as lease-purchase agreements, offer a pathway to homeownership for those not immediately ready for a traditional mortgage. Qualifying for such a deal involves several key factors. Credit score plays a crucial role, though requirements are often less stringent than traditional mortgages. Lenders will still assess your credit history, looking for responsible financial behavior. Income stability is another vital aspect, demonstrating your ability to make consistent, timely payments. Landlords want assurance you can handle the financial responsibility of owning a home. Finally, a down payment is typically required, similar to a traditional purchase. This demonstrates your commitment to the property and provides a financial cushion for the seller.

Beyond these core requirements, rent-to-own agreements often involve additional considerations. The option fee, a non-refundable upfront payment, secures your right to purchase the property at the end of the lease term. It’s important to understand the terms of this fee and how it affects the overall cost. Rent premiums are also common, meaning a portion of your monthly rent contributes towards the eventual purchase price. This structure helps build equity over time. Careful evaluation of the purchase price outlined in the agreement is critical, ensuring it aligns with market value and your long-term financial goals.

Preparing for a rent-to-own agreement requires diligent financial planning. Review your credit report, addressing any inaccuracies and striving to improve your score. Documenting a consistent income stream through pay stubs and tax returns will bolster your application. Saving for the initial down payment and option fee requires proactive budgeting and financial discipline. Understanding the specific terms and conditions of the rent-to-own agreement is paramount. Seek professional advice from a real estate attorney or financial advisor to ensure the terms are fair and align with your individual circumstances.

Lease Terms and Purchase Clauses

Lease terms outline the duration, payment schedule, and responsibilities of both the landlord (lessor) and tenant (lessee) during the lease period. Key terms include the commencement and termination dates, the monthly rent amount, and details regarding property maintenance, utilities, and permitted use of the premises. Clearly defined lease terms are crucial for establishing a mutually understood agreement and preventing disputes.

Purchase clauses within a lease agreement provide a tenant with the option to buy the leased property under specified conditions. These clauses typically include the purchase price, the timeframe within which the option can be exercised, and any pre-agreed terms impacting the sale. A common example is a lease-option agreement, which allows a portion of the rent paid to contribute towards the eventual purchase price, should the tenant decide to buy.

Both lease terms and purchase clauses should be carefully reviewed and understood by all parties involved before signing any agreement. It is strongly recommended that legal counsel be sought to ensure your rights and obligations are fully protected.

Common Pitfalls to Avoid

When undertaking a new project or task, it’s easy to fall into common traps that can hinder progress and success. One frequent mistake is inadequate planning. Failing to thoroughly define goals, assess resources, and anticipate potential problems can lead to delays, cost overruns, and ultimately, an unsatisfactory outcome. Another pitfall is poor communication. Clear and consistent communication among team members, stakeholders, and clients is crucial for ensuring everyone is on the same page and working towards a shared vision. Without it, misunderstandings and conflicts can arise, derailing the project.

Another common mistake is neglecting to track progress and adapt to changing circumstances. Regularly monitoring milestones, identifying roadblocks, and adjusting plans as needed is essential for staying on track and achieving desired results. Ignoring these elements can lead to missed deadlines, unmet objectives, and a general sense of disorganization. By being mindful of these potential pitfalls and taking proactive steps to avoid them, you can significantly increase your chances of success in any endeavor.

Finally, avoid the trap of analysis paralysis. While gathering information and considering options is important, spending too much time in the planning phase can be counterproductive. At some point, you must make a decision and move forward. Overthinking can lead to missed opportunities and stalled progress. Decisiveness, coupled with careful planning, is a key ingredient for success.

Is It Better Than Buying Right Away?

Leasing versus buying outright depends heavily on individual circumstances and priorities. Leasing often results in lower monthly payments and requires a smaller upfront commitment, making it appealing for those prioritizing affordability. However, you won’t own the asset at the end of the lease term. Buying, while requiring a larger initial investment, builds equity and ultimately leads to ownership.

Consider your long-term needs. If you value flexibility and prefer driving a new car every few years, leasing could be a good option. If you prioritize long-term cost savings and ownership, buying may be the better choice. Think about your usage as well. Leases often have mileage restrictions, which could incur extra fees if exceeded.

Evaluating your financial situation, including your credit score and available down payment, is crucial. Carefully compare the total cost of leasing (including monthly payments and any end-of-lease fees) with the total cost of buying (including loan payments, interest, and potential depreciation). This comparison will help you make the most informed decision.

When Rent-to-Own Makes Sense

Rent-to-own (RTO) can be a viable path to homeownership for individuals facing certain financial hurdles. It’s particularly attractive to those with poor credit or a lack of down payment. RTO agreements allow prospective buyers to build equity over time while renting, essentially locking in a purchase price. This can be beneficial in a rising market. However, it’s crucial to understand the higher costs often associated with RTO. The option price (the future purchase price) is typically inflated, and monthly payments may be higher than a standard rental agreement. A portion of these payments contributes toward the eventual purchase, but a significant portion covers rent and other fees.

RTO makes the most sense when you have a reasonable expectation of improving your financial situation within the rental period. This might include repairing your credit score, accumulating savings for a down payment, or securing a higher-paying job. It’s essential to thoroughly review the contract and understand all terms, including the option fee, purchase price, maintenance responsibilities, and the consequences of defaulting on the agreement. Seek legal counsel if necessary to ensure you’re protected.

Before entering into an RTO agreement, carefully consider your alternatives. Explore traditional mortgage options, even with a low credit score. Down payment assistance programs might also be available. Weigh the long-term costs and risks of RTO against other pathways to homeownership. If you’re confident in your ability to meet the terms of the RTO agreement and improve your financial standing, it can be a helpful stepping stone. However, proceeding with caution and a full understanding of the implications is essential.