Understanding property taxes is crucial for every homeowner. This comprehensive guide provides a clear explanation of property tax assessments, calculations, and payments. Whether you are a first-time homebuyer, a seasoned investor, or simply looking to gain a better understanding of your property tax obligations, this guide will equip you with the knowledge you need. Learn how property taxes are levied, what factors influence your property tax rate, and how you can potentially reduce your property tax burden. From property tax exemptions to appealing your assessment, we cover all aspects of this essential component of homeownership.

Navigating the complexities of property taxes can be daunting. This guide breaks down the property tax system into manageable sections, offering practical advice and helpful tips. We will explore the differences in property taxes across various jurisdictions, discuss the importance of property tax appeals, and highlight resources available to homeowners. Gain a deeper understanding of how property taxes fund essential public services and learn how to effectively manage your property tax liability. Empower yourself with the information you need to confidently navigate the world of property taxes and protect your investment.

What Are Property Taxes?

Property taxes are ad valorem taxes, meaning they are assessed based on the value of a property. These taxes are levied on real estate, which can include land, buildings, and other improvements. Local governments, such as counties, municipalities, and school districts, primarily use property tax revenue to fund essential public services like schools, roads, police and fire departments, and parks.

The amount of property tax owed is calculated by multiplying the assessed value of the property by the applicable tax rate. The assessed value is typically determined by a government assessor and represents a percentage of the property’s market value. The tax rate is established by the local taxing authorities and is often expressed as a percentage or in mills (dollars per $1,000 of assessed value). Exemptions may be available for certain properties or property owners, such as homeowners, senior citizens, or disabled veterans, potentially reducing the taxable value.

Property taxes are a significant source of funding for local governments and play a crucial role in supporting local communities. They allow local jurisdictions to provide necessary services and infrastructure to residents without relying solely on state or federal funding. It’s important for property owners to understand how these taxes are calculated and to pay them on time to avoid penalties.

How Property Taxes Are Calculated

Property taxes are calculated using a relatively straightforward process, though the specifics can vary by jurisdiction. The process begins with determining the assessed value of your property. This value, often a percentage of the property’s market value, is established by your local government’s assessor. Factors influencing assessed value include the property’s size, location, age, condition, and any recent improvements.

Once the assessed value is determined, it’s multiplied by the tax rate, also known as the millage rate. This rate is set by local governing bodies such as counties, cities, school districts, and other special taxing districts. The millage rate is often expressed as dollars per $1,000 of assessed value (e.g., a millage rate of 10 mills means $10 of tax for every $1,000 of assessed value). Therefore, your property tax is calculated as: Assessed Value x Millage Rate = Property Tax.

While the core calculation is consistent, variations can exist. Some jurisdictions offer exemptions or deductions that can reduce the taxable value of your property. These can include exemptions for homeowners, seniors, veterans, or agricultural land. It’s crucial to consult your local tax assessor’s office for precise details about your area’s specific rules and regulations.

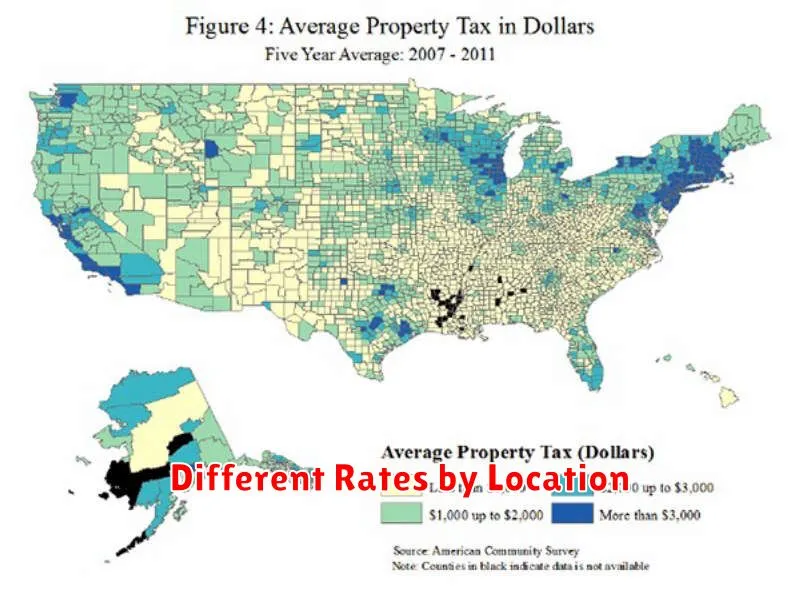

Different Rates by Location

Location plays a significant role in determining various rates, including property taxes, insurance premiums, and even hourly wages. Geographic factors such as population density, proximity to resources, local regulations, and the overall cost of living contribute to these variations. For example, property taxes tend to be higher in areas with robust public services and high property values, while insurance premiums can fluctuate based on the likelihood of natural disasters or crime rates in a particular location. Understanding these localized differences is crucial for individuals and businesses when making financial decisions.

Businesses, in particular, must consider location-based rate differences when planning budgets and expansion strategies. Operating costs can vary dramatically depending on where a business is located, affecting profitability and long-term sustainability. Factors such as labor costs, utility rates, and transportation expenses are all influenced by geography. Conducting thorough research and analysis of the local economic landscape is essential for businesses to make informed decisions about location choices.

Furthermore, individuals should also be aware of how location impacts their personal finances. Cost of living discrepancies between different cities and regions can significantly impact disposable income and overall financial well-being. Housing costs, transportation expenses, and everyday necessities like groceries can vary dramatically from one location to another. Careful consideration of these location-based rate variations is vital for individuals making decisions about where to live and work.

How to Estimate Your Annual Tax Bill

Estimating your annual tax bill requires understanding your income, deductions, and credits. Income includes wages, salaries, investment income, and any other earnings subject to taxation. Determine your gross income, which is your total income before any deductions. Next, consider applicable deductions. Common deductions include those for student loan interest, itemized expenses (like medical expenses or charitable contributions), or the standard deduction, a fixed amount based on your filing status. Subtracting deductions from your gross income yields your adjusted gross income (AGI). Your AGI is crucial for determining your tax liability.

Once you have your AGI, you can estimate your taxable income by subtracting any eligible credits. Credits directly reduce the amount of tax you owe. Examples include the Earned Income Tax Credit or the Child Tax Credit. After applying credits, consult the relevant tax brackets for your filing status (single, married filing jointly, etc.). Tax brackets outline the percentage of your income that will be taxed at different income levels. Apply the appropriate percentages to your taxable income to calculate your estimated tax liability.

While this method provides a reasonable estimate, consulting a tax professional or utilizing reputable tax software can provide a more precise calculation. Tax laws are complex and subject to change. Keeping accurate records of your income and expenses throughout the year will simplify the estimation process and ensure a smoother tax filing experience.

Exemptions and Reductions Available

Several exemptions and reductions can lessen your overall tax burden. These can include deductions for certain expenses like charitable contributions or education expenses, as well as credits that directly reduce the amount of tax you owe. Eligibility requirements vary, so it’s crucial to understand which exemptions and reductions apply to your specific situation.

Common exemptions often pertain to dependents, while reductions may be available for specific demographic groups, such as seniors or low-income individuals. Understanding these provisions can significantly impact your tax liability. Consult the relevant tax guidelines or a qualified tax professional for detailed information regarding eligibility criteria and applicable limits.

Properly claiming exemptions and reductions is essential for accurate tax filing. Failure to do so could result in overpaying or potential penalties. Carefully review the instructions and seek professional advice if needed to ensure you are maximizing your eligible benefits.

How to Pay and Track Property Taxes

Property taxes are typically paid to your local county tax assessor or collector. Payment methods often include online portals, mail, phone, or in-person visits to the tax office. Be sure to check with your local tax authority for specific instructions and accepted payment types. Deadlines for property tax payments vary by jurisdiction, so it’s crucial to know your due date to avoid penalties. Late payment can result in interest charges, liens against your property, or even foreclosure in extreme cases.

Tracking your property taxes is essential for responsible homeownership. You can usually find your property tax information online through your county’s tax assessor website. These websites typically allow you to search by property address, owner name, or parcel number. Keep records of all your property tax payments, including payment confirmation numbers and dates. This documentation can be valuable for tax purposes and in case of any discrepancies.

Understanding your property tax obligations can seem complex, but resources are available to help. Contacting your local tax assessor’s office directly is often the best way to get specific answers to your questions. Additionally, many states and counties offer online resources and guides explaining property tax assessments, payment options, and exemptions. Staying informed about your property taxes will help you avoid potential problems and maintain good standing with your local government.

Why It Matters When Buying a Home

Buying a home is one of the most significant financial decisions you’ll ever make. It’s not just about finding a place to live; it’s an investment in your future. The timing of your purchase can significantly impact your financial well-being. Factors like current mortgage rates, the housing market climate (buyer’s market vs. seller’s market), and your personal financial readiness (credit score, down payment) all play a crucial role in determining whether it’s the right time to buy.

Understanding market trends is crucial. A buyer’s market, characterized by lower prices and more inventory, presents opportunities for negotiation and potentially better deals. Conversely, a seller’s market, marked by higher prices and limited inventory, can be more competitive and require quicker decisions. Monitoring these trends can help you make an informed decision and potentially save money in the long run.

Finally, your personal finances are paramount. A strong credit score can qualify you for better interest rates, saving you thousands of dollars over the life of your loan. Having a substantial down payment can reduce your monthly mortgage payments and help you build equity faster. Carefully assessing your financial situation before entering the housing market is essential for a successful and less stressful home-buying experience.